Title: 5 Common Knowledge Management Mistakes Insurance Executives Make

Introduction: In today’s digital age, insurance companies are facing the challenge of efficiently processing and utilizing the vast amount of information they generate and receive. Knowledge Management (KM) plays a pivotal role in contemporary businesses, facilitating the identification, management, and utilization of existing knowledge for organizational benefit. However, insurance executives often make mistakes when implementing KM policies, which can lead to significant losses. In this blog post, we will discuss the five common knowledge management mistakes insurance executives make and what they can do instead to avoid them.

Main Body:

-

Focusing only on data acquisition and storage solutions: Insurance executives often invest disproportionately in data acquisition and storage solutions, overlooking the importance of human-centric approaches in deriving meaning from data. Instead, they should focus on integrating information technologies to enhance data collection, analysis, processing, and distribution within insurance companies.

-

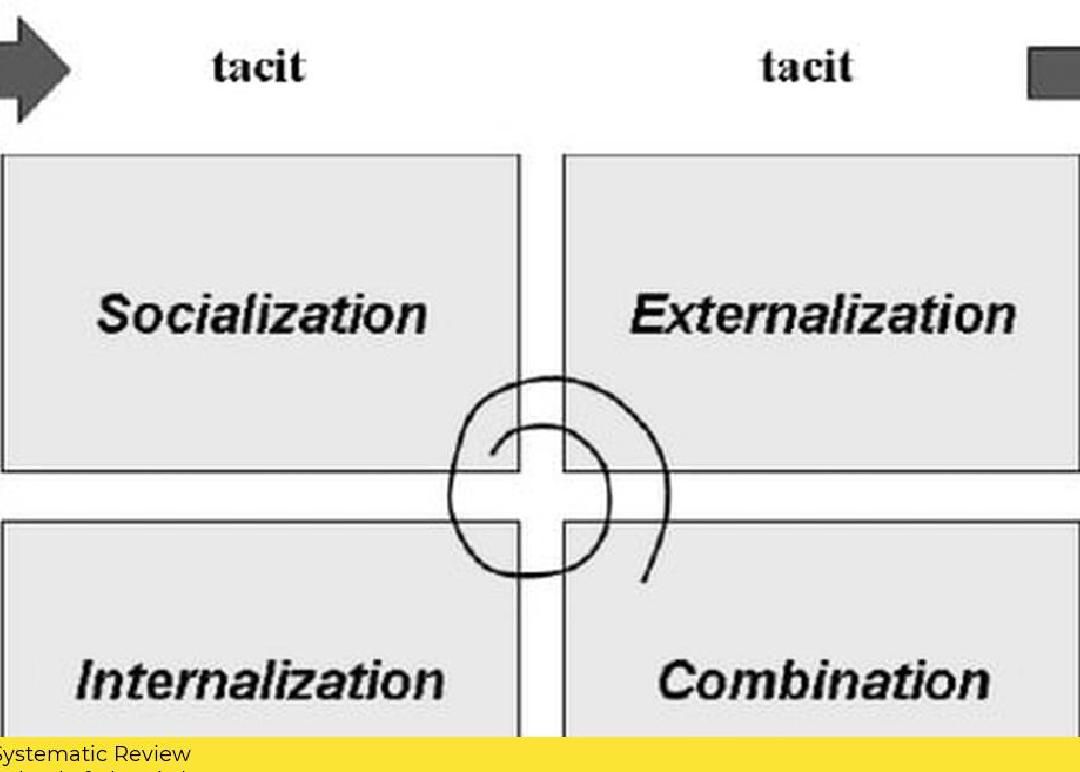

Neglecting the importance of human-centric approaches: Insurance executives often overlook the importance of human-centric approaches in deriving meaning from data. They should focus on creating a culture of knowledge sharing and collaboration, where employees are encouraged to share their knowledge and expertise.

-

Not investing in training and development: Insurance executives often neglect to invest in training and development programs for their employees. They should provide their employees with the necessary training and development opportunities to enhance their skills and knowledge.

-

Not leveraging technology to its full potential: Insurance executives often fail to leverage technology to its full potential. They should invest in advanced technologies such as artificial intelligence and machine learning to enhance their KM processes.

-

Not measuring the effectiveness of their KM policies: Insurance executives often fail to measure the effectiveness of their KM policies. They should establish key performance indicators (KPIs) to measure the effectiveness of their KM policies and make necessary adjustments.

Conclusion: In conclusion, insurance executives need to avoid these common knowledge management mistakes to ensure the success of their KM policies. With Riskwolf, insurance companies can turn real-time data into insurance. Using unique real-time data and dynamic risk modeling, Riskwolf enables insurers to build and operate parametric insurance at scale. Simple. Reliable. Fast. To learn more about how Riskwolf can help your insurance company, visit our website at [insert link to Riskwolf website]. For more information on the importance of KM in the insurance industry, read the article “Knowledge Management for Improved Digital Transformation in Insurance Companies: Systematic Review and Perspectives” by Elgargouh and Younes.