IndiGo Airlines IT System Failure: A Wake-Up Call for Insurance Executives

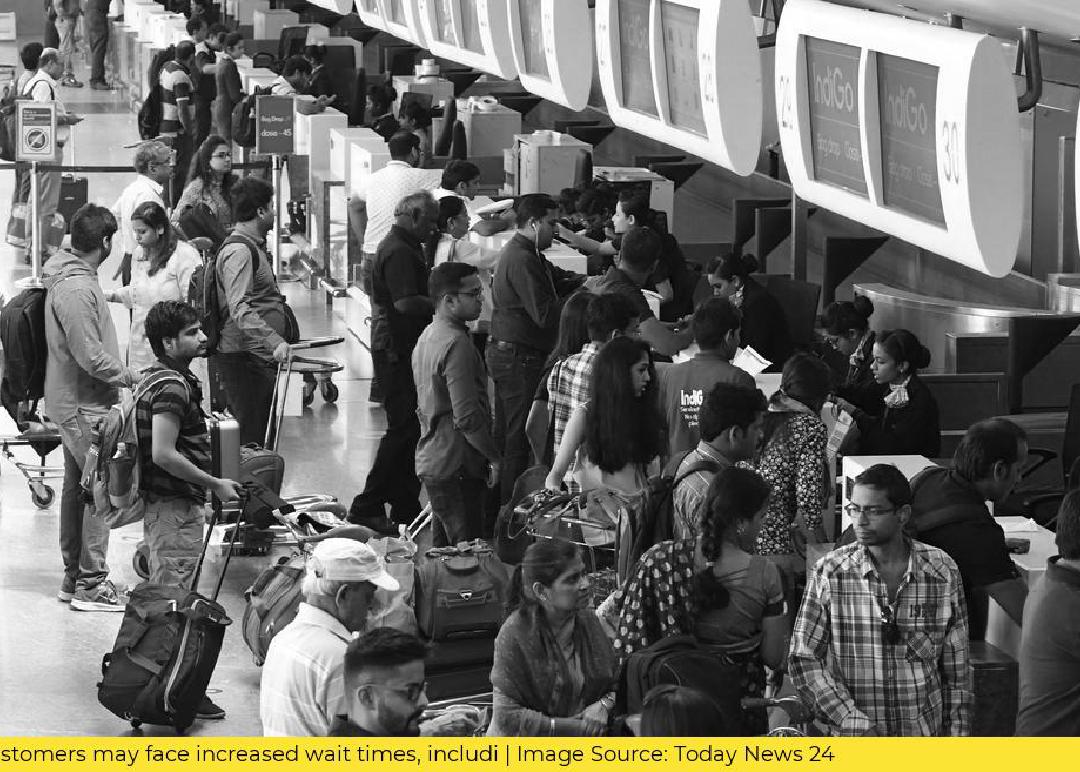

On October 5th, 2024, IndiGo Airlines faced a major IT system failure that resulted in hundreds of delayed flights and a few cancellations. Passengers were unable to carry out flight bookings or web check-ins, and had to be issued handwritten boarding passes at the airport. The airline issued a statement saying, “We are currently experiencing a temporary system slowdown across our network, affecting our website and booking system. As a result, customers may face increased wait times, including slower check-ins and longer queues at the airport.” This incident serves as a wake-up call for insurance executives to consider the importance of parametric insurance.

Passengers from airports such as Bengaluru, Kochi, and Male (Maldives) took to social media to recount their ordeal. The airline operates more than 2,000 flights per day, and the IT system failure caused chaos across the network. According to flight tracking website flightradar24, between 10 a.m. to 8 p.m., there were over 60 departures delayed from Delhi’s Indira Gandhi International Airport by over 30 minutes, nearly 55 departures delayed from Mumbai, 37 from Kolkata, and 77 from Bengaluru.

This incident highlights the importance of having a backup plan in case of IT system failures. Insurance executives need to consider the impact of such incidents on their business and customers. The delay in flights caused inconvenience to passengers, and the airline had to bear the cost of issuing handwritten boarding passes. This incident could have been avoided if the airline had parametric insurance in place.

Parametric insurance is a type of insurance that pays out when a predefined event occurs. It is based on a specific parameter, such as the magnitude of an earthquake or the wind speed of a hurricane. In the case of IndiGo Airlines, parametric insurance could have been used to cover the cost of delays caused by IT system failures. The airline could have set a parameter for the number of delayed flights or the duration of the delay, and the insurance would have paid out accordingly.

With Riskwolf, insurance executives can turn real-time data into insurance. Using unique real-time data and dynamic risk modeling, Riskwolf enables insurers to build and operate parametric insurance at scale. Simple. Reliable. Fast. Insurance executives need to consider the importance of parametric insurance in today’s world, where IT system failures can cause chaos and inconvenience to customers.

In conclusion, the IT system failure faced by IndiGo Airlines serves as a wake-up call for insurance executives to consider the importance of parametric insurance. The delay in flights caused inconvenience to passengers and cost the airline money. Insurance executives need to consider the impact of such incidents on their business and customers and have a backup plan in place. With Riskwolf, insurance executives can build and operate parametric insurance at scale, ensuring that their business is protected in case of unforeseen events. Don’t wait for a disaster to strike, get in touch with Riskwolf today.

(Source: Today News 24)