How to Build and Operate Parametric Insurance at Scale

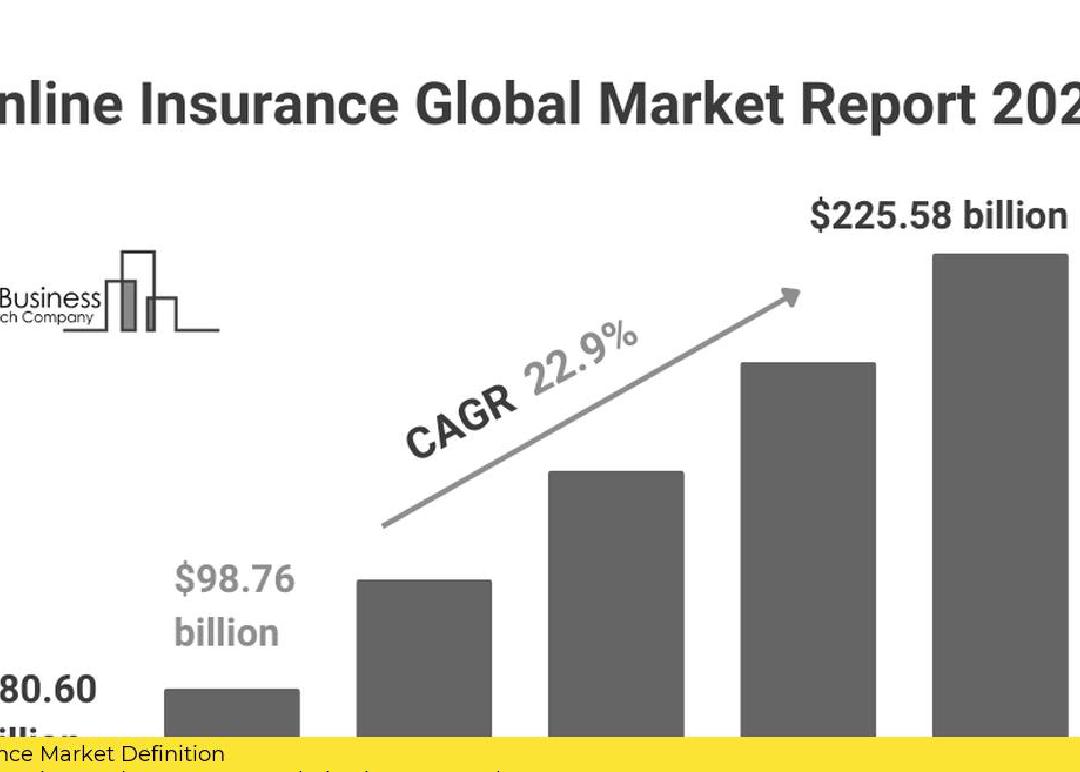

As an insurance executive, you know that the online insurance market is growing exponentially. According to a report by The Business Research Company, the market size will grow from $80.60 billion in 2023 to $98.76 billion in 2024 at a compound annual growth rate (CAGR) of 22.5%. The growth in the forecast period can be attributed to increased mobile usage, internet usage continuing to rise, and growing awareness of the benefits of having health coverage.

But with growth comes risk. As the world becomes more connected, natural disasters and other catastrophic events are becoming more frequent and severe. Traditional insurance policies may not be enough to protect your clients from the financial impact of these events. That’s where parametric insurance comes in.

Parametric insurance is a type of insurance that pays out a predetermined amount based on the occurrence of a specific event, such as a hurricane or earthquake. Unlike traditional insurance policies, which require extensive claims processing and investigation, parametric insurance uses real-time data to trigger payouts automatically. This makes it faster, more efficient, and more reliable than traditional insurance.

Here are five steps to building and operating parametric insurance at scale:

-

Identify the risks: The first step in building parametric insurance is to identify the risks that your clients face. This could include natural disasters, supply chain disruptions, or other events that could impact their business.

-

Collect real-time data: Once you’ve identified the risks, you need to collect real-time data that can be used to trigger payouts. This could include data from weather sensors, seismic monitors, or other sources.

-

Develop a risk model: Using the real-time data, you can develop a risk model that will determine when payouts should be triggered. This model should be based on historical data and should take into account the specific needs of your clients.

-

Build the platform: With the risk model in place, you can build the platform that will allow you to offer parametric insurance to your clients. This platform should be scalable, reliable, and easy to use.

-

Operate the platform: Once the platform is built, you can begin offering parametric insurance to your clients. You’ll need to monitor the real-time data and adjust the risk model as needed to ensure that payouts are triggered accurately.

With Riskwolf, you can turn real-time data into insurance. Using unique real-time data and dynamic risk modelling, we enable insurers to build and operate parametric insurance at scale. Simple. Reliable. Fast. Book your 30 minutes free consultation with our research experts to learn more about how we can help you build and operate parametric insurance for your clients.

In conclusion, as the online insurance market continues to grow, it’s important for insurance executives to stay ahead of the curve. By building and operating parametric insurance at scale, you can offer your clients faster, more efficient, and more reliable protection against the risks they face. Don’t take chances with attention, get in touch with Riskwolf today.

Source: The Business Research Company